What is udyam registration?

Udyam Registration is a initiative in India introduced by the Ministry of Micro, Small, and Medium Enterprises (MSME) in July 2020. It replaces the earlier MSME enrollment process known as udyog registration. Udyam Registration is an online registration process for micro, small, and medium enterprises (MSMEs) in India. It aims to simplify the registration process for MSMEs and provide them with various benefits and incentives such as easier access to credit, subsidies, and other support schemes.

Classification of MSME

The classification of Micro, Small, and Medium Enterprises (MSMEs) in India is based on their investment in plant and machinery or equipment, as well as annual turnover. Here are the criteria for classification:

Micro Enterprises

- Investment in plant and machinery or equipment does not exceed INR 1 crore.

- Annual turnover does not exceed INR 5 crore.

Small Enterprises

- Investment in plant and machinery or equipment is more than INR 1 crore but does not exceed INR 10 crore.

- Annual turnover is more than INR 5 crore but does not exceed INR 50 crore.

Medium Enterprises

- Investment in plant and machinery or equipment is more than INR 10 crore but does not exceed INR 50 crore.

- Annual turnover is more than INR 50 crore but does not exceed INR 250 crore.

These classifications are used for various purposes, including availing benefits and incentives such as accessing credit facilities, and participating in procurement programs. MSMES need to register themselves under the appropriate category to avail themselves of the benefits.

Difference between udyam registration, MSME registration and udyog registration:

The Udyam Registration, msme registration and udyog Registration are initiatives aimed at registering and providing benefits to Micro, Small, and Medium Enterprises (MSMEs), but they differ in several aspects:

Udyam Registration:

- Udyam Registration is a new registration process introduced for micro, small, and medium-sized enterprises (MSMEs).

- It replaced the earlier process of MSME Registration. Now, businesses need to register under Udyam to avail benefits provided to MSMEs.

- The registration is based on self-declaration of certain criteria like investment in plant and machinery or equipment, turnover, etc.

- Once registered, businesses receive a Udyam Registration Certificate.

MSME Registration:

- MSME Registration was the old process of registering micro, small, and medium-sized enterprises (MSMEs) in India.

- It was replaced by Udyam Registration.

- Under MSME Registration, businesses had to submit certain documents and information to the respective authorities for registration.

- This registration allowed MSMEs to avail various benefits and incentives like subsidies, schemes, etc.

Udyog Registration:

1. Initiative and Purpose:

- Udyog Registration : It was introduced as a simplified registration process for MSMEs to avail themselves of benefits and incentives provided.

- Udyam Registration : Introduced to replace udyog Registration, Udyam Registration is a more streamlined and updated process that aims to further simplify registration for MSMEs and enhance their access to benefits and support schemes.

- MSME Registration was an earlier initiative aimed at providing recognition and support to micro, small, and medium-sized enterprises. Its purpose was to facilitate the growth and development of MSMEs by offering them various benefits and incentives.

2. Registration Criteria:

- Udyog Registration : Under udyog , MSMEs were classified based on their investment in plant and machinery or equipment, along with annual turnover.

- Udyam Registration : The classification criteria under Udyam Registration remain the same as udyog , based on investment and turnover, but the registration process and platform have been updated.

- MSME Registration : The criteria for MSME Registration were similar to Udyam Registration, based on investment in plant and machinery or equipment and turnover.

3. Registration Process:

- Udyog Registration : The registration process was primarily online and required basic details of the MSME, such as number, business name, address, etc.

- Udyam Registration : Udyam Registration is a completely online process, aiming for greater ease of use and efficiency. It involves providing necessary details about the business and its classification according to the criteria.

- MSME Registration involved submitting certain documents and information to the respective authorities. The process varied from state to state but typically required documents such as card, , business address proof, and details of the business activities.

4. Benefits and Incentives:

- Both udyog and Udyam Registration aim to provide MSMEs with benefits such as easier access to credit, subsidies, schemes, and preferential treatment in procurement.

- The transition from udyog to Udyam Registration does not significantly alter the benefits available to MSMEs. Still, the updated process may lead to better implementation and access to these benefits.

- MSMEs registered under this process were eligible for benefits such as credit guarantee schemes, subsidies on loans, and exemption from certain taxes. They could also avail themselves of schemes aimed at promoting MSME growth in various sectors.

Udyam Registration, MSME Registration and udyog Registration serve the same purpose of registering MSMEs for benefits, Udyam Registration is a more updated and streamlined version of the process to improve accessibility and efficiency for MSMEs.

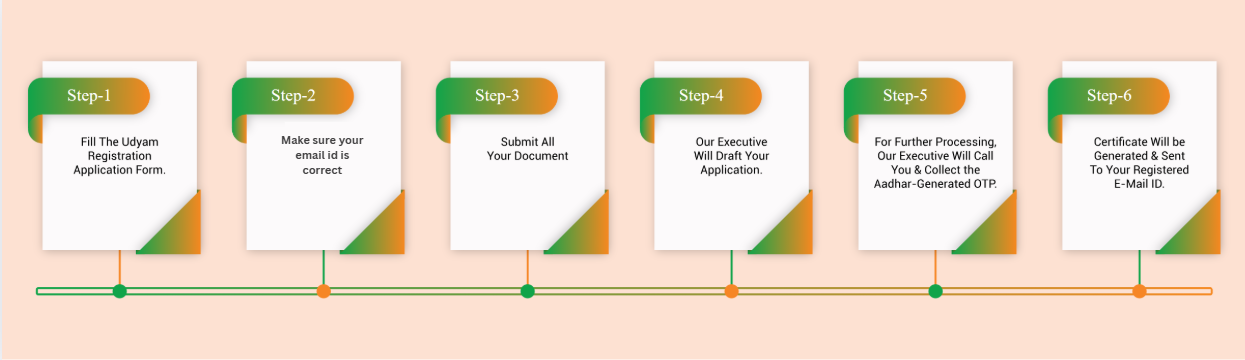

Udyam Registration Process:

Here is the step-by-step guide for udyam registration process:

- Step 2: Click on the new udyam registration tab and fill out the online application form.

- Step 3: Enter the correct business details along with personal details.

- Step 4: Dully Check the application form and click on the submit button to proceed with your udyam application.

- Step 5: One of our executives will contact you for further processing.

- Step 6: You’ll receive the certificate within 2-3 working hours on your registered email.

Note: Delay in the certificate, only when the website is under maintenance.